Well, here we are. Hope you and yours are well during these times. To those nurses, law enforcement, cashiers and delivery drivers out there, thanks for what you are doing. I think we are all amazed by how quickly our lives have been turned upside down. Though first and foremost we are all concerned about the health of our friends and families, in our world of managing portfolios, money also is on the mind of many.

After a 10-year bull market, we knew a downturn was coming, we just didn’t know it would be a global pandemic that would be the catalyst. Clients each have a unique risk profile and timeline, and as such, are able to weather the markets better than say someone who just buys an index fund that doesn’t match their mental ability to handle it. If you don’t know your risk profile and how that matches your portfolio, you should and this may be a great time to check that box off.

The Shift to a New Way of Doing Business

Things are going to go somewhat back to normal, someday. But we all have to agree that something has changed in the way we all operate as humans, as parents, as workers. So the children are now being taught at home via some online communications platform. The workers are staying home and documents are being reviewed and signed via electronic modes. Most of these documents are being stored in a remote server warehouse in the cloud. We aren’t using our vehicles and also are cooking our own meals. When we aren’t working, we are cleaning the floors and faucet handles and making sure the kids wash their hands frequently. And then when the madness at home settles towards the end of day, we log into some online media provider and banish our stresses away in some series about a reformed investment advisor turned money launderer. In those previous sentences about a dozen different publicly traded companies have now sprung up as necessities in our new lives. Below is a list.

Outside of our houses there are even more changes. The Amazon, Fedex, and UPS trucks buzz by as more people decide to purchase online as opposed to venturing with masks on into a store. Travel plans have been sidelined so airlines are as quiet as can be and those mammoth obnoxious cruise ships, well, I assume they will be paying people to come aboard even when things do settle.

Big Oil’s Wake Up Call

Due to this slowdown and what looks to be a 20% unemployment rate soon to come, the machines aren’t spinning as much as they were. And when machines aren’t spinning as much (and more environmentally friendly alternative forms of energy make their way to the mainstream), well, not as much oil is being used. It’s just where we are. For the first time ever, the price of a barrel dropped below $0 temporarily. Yes, below $0! Due to the US overproducing the dirty fuel and the lack of demand, this meant producers were paying buyers to take those 42 gallon drums of oil off their hands. Prices have started to come back up since that dip though.

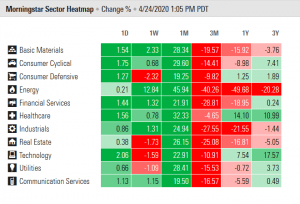

Enter the huge variance in sector performance. Below is a Morningstar graph of our different economic sectors and the performance numbers. It’s clear that the energy sector (big oil/natural gas, etc.) has just been hammered recently and even over the long term. We here still believe that investors should be (and have been) divested of this sector, but this will definitely be a wake up call to those non-sustainable ESG investors who have not paid attention and may be holding 10% or more of their portfolio in this sector. On the flip side, technology is almost becoming a staple of sorts in this modern era. If we thought that Amazon, Netflix, Paypal, Google, and Apple were gaining steam into this new world, well, its apparent this is even more solidified. We were already on the path to this “digital” world, but this recent pandemic just has sped up how quickly we’re moving in that direction. Over 1 year is an annualized rate by the way.

After witnessing last year’s 28% increase in the S&P500 and the previous 9 years before that being up (except one fairly flat year in 2018) it was easy to rest on our laurels. Now it’s to see how this market behaves and how the recovery goes. Will it be a V-shaped, U-shaped, W-shaped or an L. Who knows and only time will tell…

Stocks That MAY be the Future

Cloud software

- Salesforce.com

- Zoom Video

- DocuSign

Financials

- Square

- PayPal

Home entertainment

- Netflix

- Roku

Big Technology

- Alphabet

- Amazon

- Apple

- Microsoft

REITs Focused on the Cloud

- Digital Realty

- Equinix

Other

- Moderna

- Livongo

- Teladoc Health

- Peloton

If you are interested in a free consultation to see how sustainable your current portfolio is, feel free to reach us at info@sustainvest.com

For those looking for a full service investment advisor with financial planning included check out:

For those looking for a digital platform with sustainable investing and a $5,000 minimum balance check out:

This article is not making any recommendation for the stocks or funds listed.